Schaeffler with solid first half of 2025

2025-08-06 | Herzogenaurach

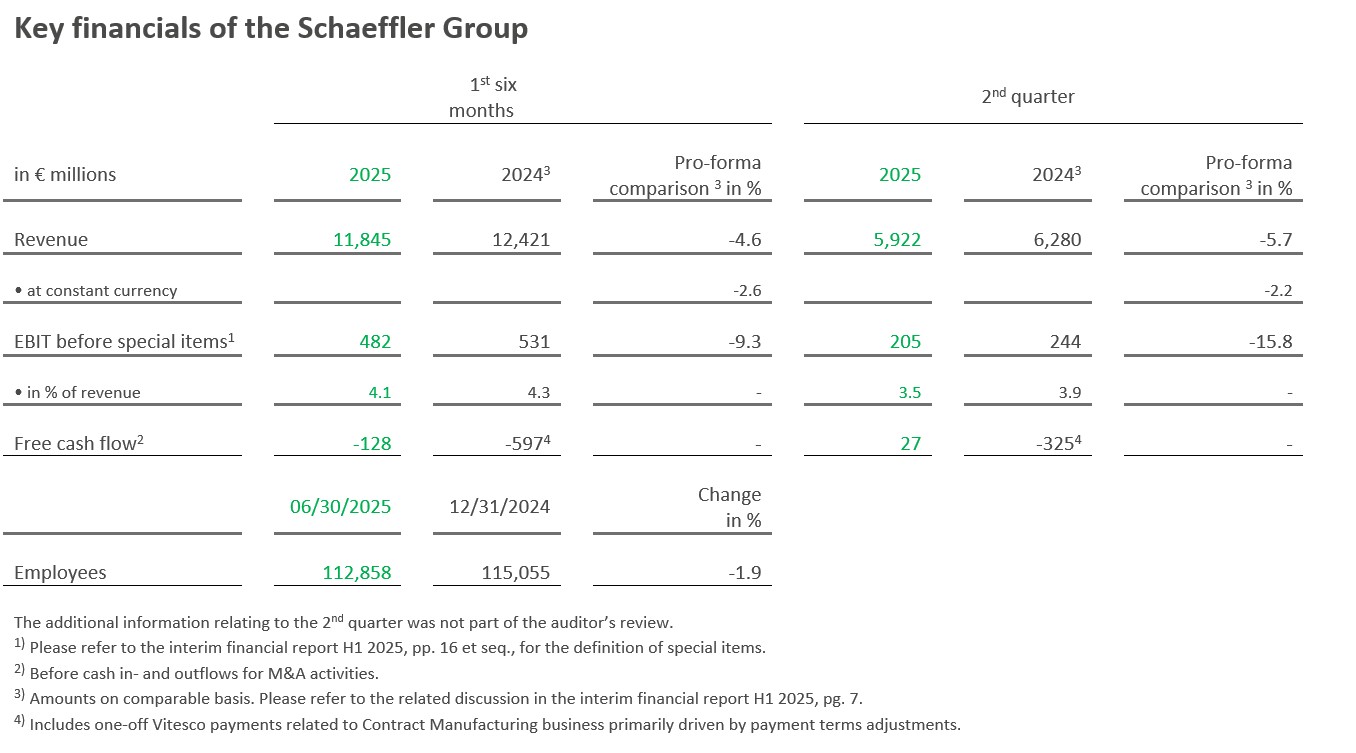

- Revenue of 11.8 billion euros slightly below prior year (pro-forma prior year H1 2024: 12.4 billion euros), constant-currency decrease of 2.6 percent

- EBIT margin before special items of 4.1 percent at prior year level (pro-forma prior year H1 2024: 4.3 percent)

- E-Mobility and Powertrain & Chassis margin trends as expected, strong contribution to earnings by Vehicle Lifetime Solutions, Bearings & Industrial Solutions EBIT margin before special items at prior year level

- Six-months free cash flow before cash in- and outflows for M&A activities improved to -128 million euros (pro-forma prior year H1 2024: -597 million euros), positive free cash flow before special items for Q2 2025

- Full-year guidance for 2025 confirmed

Schaeffler AG published its interim financial report for the first half of 2025 today. The Schaeffler Group’s revenue for the first six months of the year was 11,845 million euros; compared to the prior year level based on pro-forma amounts and at constant currency, revenue decreased slightly by 2.6 percent (pro-forma prior year: 12,421 million euros).

At group-level, regional trends were mixed in the reporting period. While revenue for the Europe and Greater China regions was down 5.2 percent and 6.1 percent from its prior year level, compared on a pro-forma basis and at constant currency, Americas and Asia/Pacific region revenue grew by 0.9 percent and 5.5 percent, compared on a pro-forma basis and at constant currency.

The Schaeffler Group generated 482 million euros in EBIT before special items in the first six months of 2025 (pro-forma prior year: 531 million euros). The EBIT margin before special items of 4.1 percent was flat with prior year, compared on a pro-forma basis (pro-forma prior year: 4.3 percent).

Klaus Rosenfeld, CEO of Schaeffler AG, said: “The Schaeffler Group has successfully advanced based on its new structure comprising four product-oriented divisions in the first half of 2025. The trend at the E-Mobility division is encouraging, as is the continued strong performance of our Vehicle Lifetime Solutions division which is once again contributing to the stability and strength of the company. Our broad positioning enables us to compensate for the market-driven revenue declines at the Powertrain & Chassis and Bearings & Industrial Solutions divisions. Despite the difficult environment and the ongoing integration, the Schaeffler Group is well on its way to fully utilizing its operational potential and focusing even more closely on its customer business than before.”

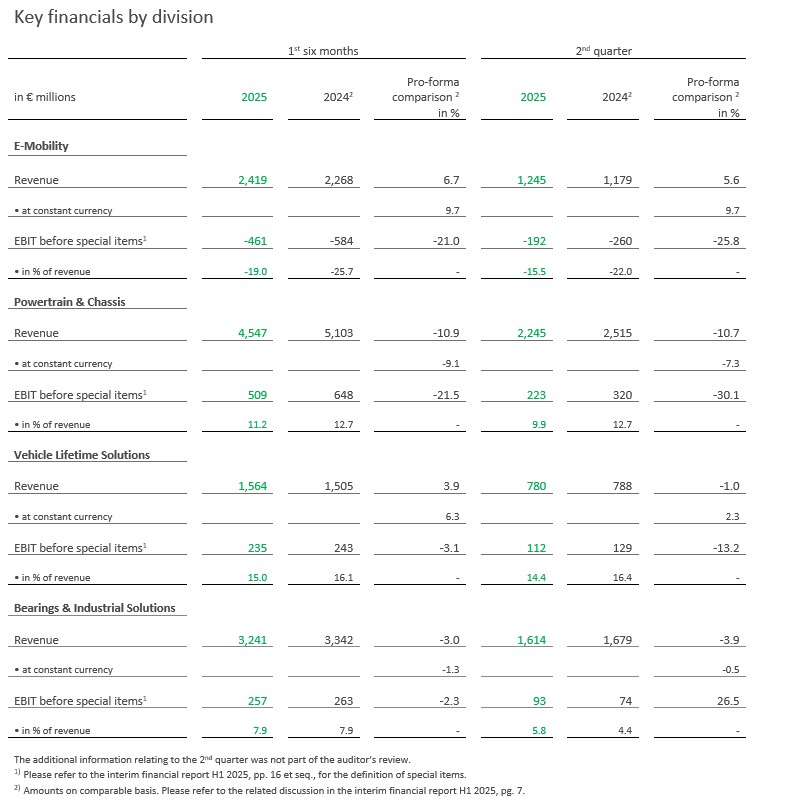

E-Mobility – Strong order intake

E-Mobility division revenue for the first half of 2025 rose by 9.7 percent, compared on a pro-forma basis and at constant currency, to 2,419 million euros (pro-forma prior year: 2,268 million euros). This was primarily attributable to increased production of electrified vehicles. Especially product-ramp ups in the Europe and Americas regions contributed to this growth. The division’s order intake for the first half of 2025 amounted to 4.6 billion euros, including 1.6 billion euros for the second quarter of 2025.

EBIT before special items of -461 million euros was generated during the reporting period (pro-forma prior year: -584 million euros), representing an improved EBIT margin before special items of -19.0 percent (pro-forma prior year: -25.7 percent). This favorable trend was mainly due to volume growth. Second-quarter EBIT before special items generated by the division was -192 million euros (pro-forma prior year: -260 million euros), representing an EBIT margin before special items of -15.5 percent (pro-forma prior year: -22.0 percent).

Powertrain & Chassis – EBIT margin before special items below pro-forma prior year

Compared on a pro-forma basis, Powertrain & Chassis division revenue for the first half of 2025 decreased by 9.1 percent, at constant currency, to 4,547 million euros (pro-forma prior year: 5,103 million euros). The main driver was a decline in demand mainly from the established manufacturers in the Europe region. Global production of vehicles with internal combustion engines declined as well. The strategic streamlining of the portfolio had an additional impact. The division’s order intake for the first half of 2025 amounted to 4.7 billion euros, including 1.9 billion euros for the second quarter of 2025.

The Powertrain & Chassis division generated EBIT before special items of 509 million euros during the reporting period (pro-forma prior year: 648 million euros). The EBIT margin before special items for the first six months of 2025 amounted to 11.2 percent (pro-forma prior year: 12.7 percent), due to the impact of volumes and foreign exchange losses, in particular.

Vehicle Lifetime Solutions – Once again strong contribution to earnings

In the Vehicle Lifetime Solutions division, revenue for the reporting period rose by 6.3 percent, compared on a pro-forma basis and at constant currency, largely due to the impact of volumes. The division generated total revenue of 1,564 million euros (pro-forma prior year: 1,505 million euros).

EBIT before special items amounted to 235 million euros (pro-forma prior year: 243 million euros), representing an EBIT margin before special items of 15.0 percent (pro-forma prior year: 16.1 percent). The decline compared on a pro-forma basis was primarily due to foreign exchange losses and the revenue mix.

Bearings & Industrial Solutions – EBIT margin before special items maintained

Bearings & Industrial Solutions division revenue for the first half of 2025 fell by 1.3 percent, compared on a pro-forma basis and at constant currency, to 3,241 million euros (pro-forma prior year: 3,342 million euros). The decline was mainly due to a market-driven decrease in volumes in the Europe region.

The division generated EBIT before special items of 257 million euros during the reporting period (pro-forma prior year: 263 million euros). The EBIT margin before special items of 7.9 percent was flat with prior year, compared on a pro-forma basis (pro-forma prior year: 7.9 percent).

Free cash flow – Considerably improved compared on a pro-forma basis

Six-months free cash flow before cash in- and outflows for M&A activities amounted to -128 million euros, considerably improved when compared on a pro-forma basis (pro-forma prior year: -597 million euros ). Capital expenditures on property, plant and equipment and intangible assets (capex) for the reporting period were 455 million euros (pro-forma prior year: 648 million euros).

Claus Bauer, CFO of Schaeffler AG, stated: “Schaeffler AG has successfully continued along its chosen path in the first half of 2025. Our free cash flow trend compared to the prior year period is positive. Despite the persistently challenging market environment and the ongoing integration of Vitesco, we have managed to maintain our earnings quality at the prior year level. Our approach of managing our financial resources proactively and with discipline is proving effective, particularly in the current difficult environment.”

Net income attributable to shareholders of the parent company was 43 million euros in the first six months; earnings per common share were 0.05 euros.

The Schaeffler Group’s net financial debt amounted to 5,255 million euros as at June 30, 2025, and the net financial debt to EBITDA ratio before special items on a pro-forma basis as at the same date was 2.4. The ratio of net financial debt to shareholders’ equity (gearing ratio) amounted to 156 percent.

The company had a workforce of 112,858 employees worldwide as at June 30, 2025.

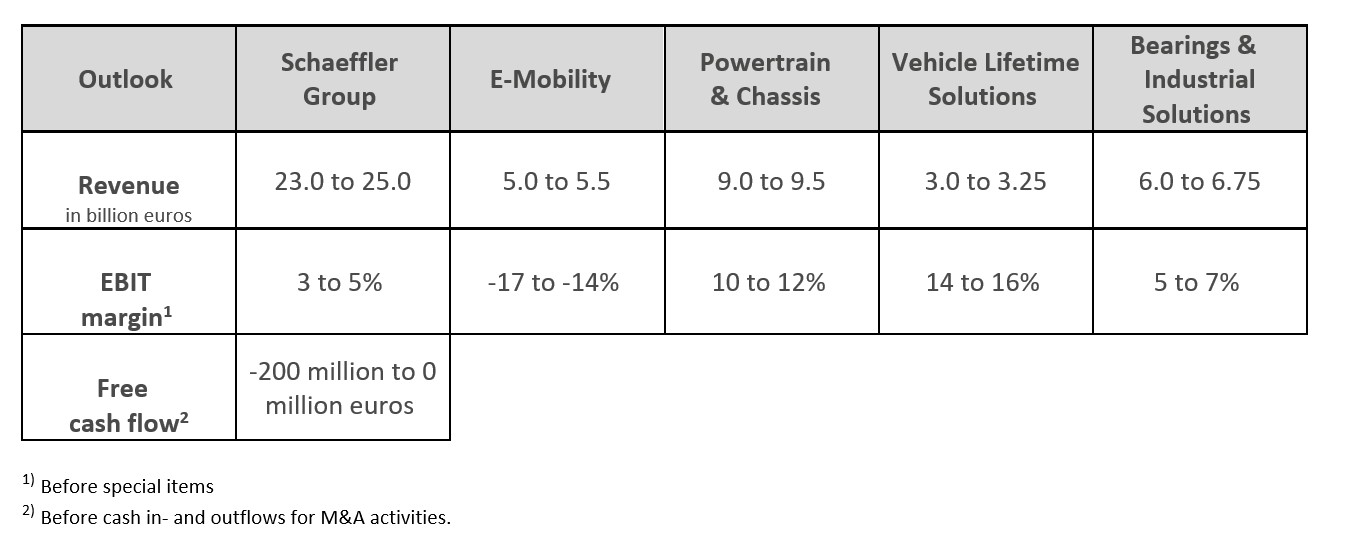

Schaeffler Group outlook confirmed – High volatility persists

The Board of Managing Directors of Schaeffler AG confirmed the outlook issued on February 18, 2025, at its meetings on April 28, 2025, and July 28, 2025.

“Despite the challenging environment and the demands of the integration of Vitesco and the further transformation of the Schaeffler Group, we are maintaining our outlook. We are confident that our diversified positioning makes us well-equipped to respond appropriately and flexibly to the challenges ahead,” Klaus Rosenfeld said.

1 The pro-forma comparative amounts are based on the assumption that Vitesco was acquired as at January 1, 2024, and is therefore included in full in the prior year amounts. See pg. 7 of the interim financial report H1 2025 for further information. The above pro-forma amounts 2024 and the related information were not subject to the 2024 financial statement audit.

2 Includes one-off Vitesco payments related to Contract Manufacturing business primarily driven by payment terms adjustments.

You can find press photos of the Executive Board members here: www.schaeffler.com/en/executive-board

Forward-looking statements and projections

Certain statements in this press release are forward-looking statements. By their nature, forward-looking statements involve a number of risks, uncertainties and assumptions that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements. These risks, uncertainties and assumptions could adversely affect the outcome and financial consequences of the plans and events described herein. No one undertakes any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. You should not place any undue reliance on forward-looking statements which speak only as of the date of this press release. Statements contained in this press release regarding past trends or events should not be taken as representation that such trends or events will continue in the future. The cautionary statements set out above should be considered in connection with any subsequent written or oral forward-looking statements that Schaeffler, or persons acting on its behalf, may issue.

Publisher: Schaeffler AG

Country: Germany

Press releases

Package (Press release + media)