Schaeffler delivers robust third quarter

2025-11-04 | Singapore

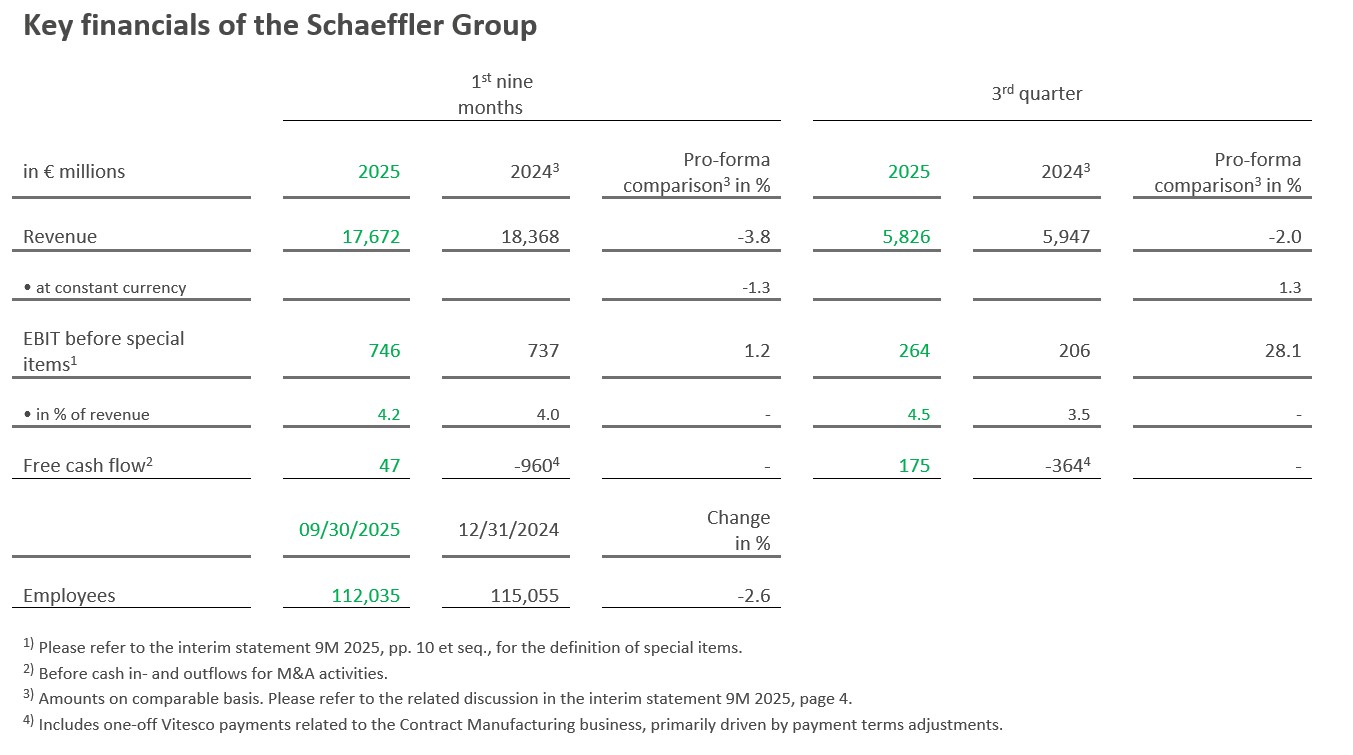

- Revenue of 17.7 billion euros for the first nine months slightly below pro-forma prior year (Q3 2025: constant-currency revenue growth 1.3 percent)

- EBIT margin before special items of 4.2 percent slightly above pro-forma prior year (Q3 2025: 4.5 percent)

- Free cash flow before cash in- and outflows for M&A activities of 47 million euros improved considerably (Q3 2025: 175 million euros)

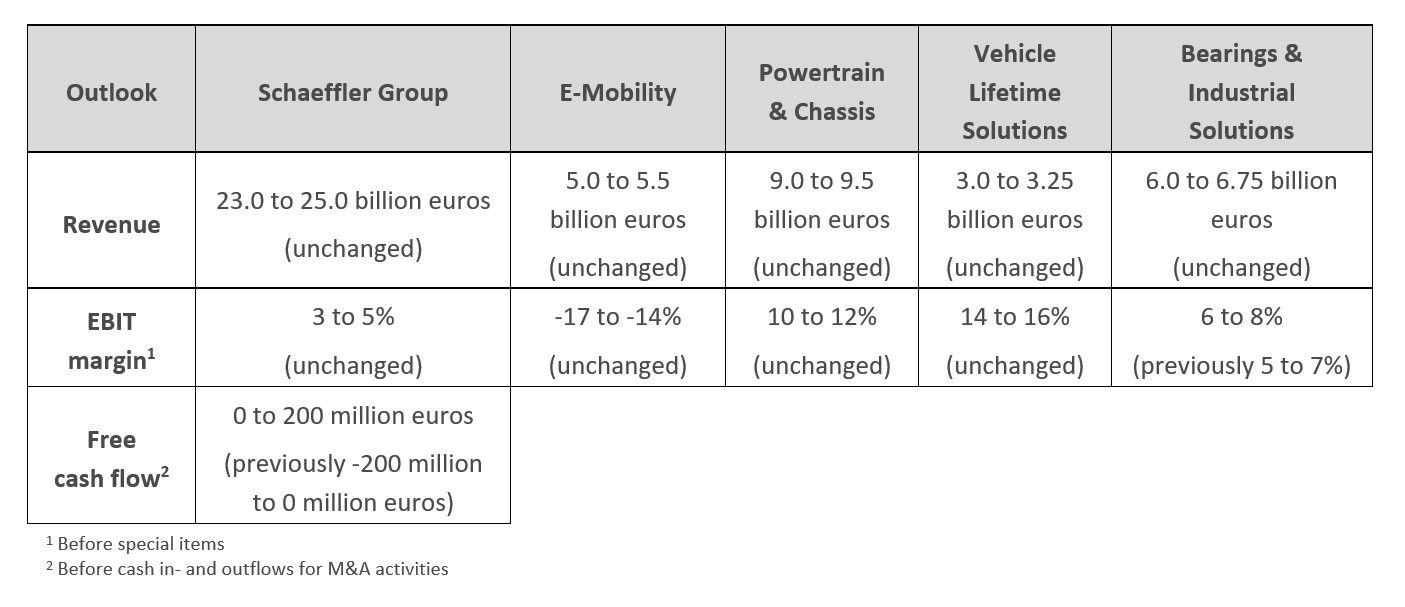

- Full-year outlook for 2025 free cash flow before M&A activities raised to 0 to 200 million euros (previously: -200 to 0 million euros). Adjusted EBIT margin guidance for Bearings & Industrial solutions increased to 6 to 8 percent (previously 5 to 7 percent).

Schaeffler AG published its results for the first nine months of 2025 today. Revenue for the reporting period amounted to 17,672 million euros, a constant-currency decrease of 1.3 percent compared on a pro-forma basis (pro-forma prior year: 18,368 million euros). The group’s revenue for the third quarter rose by 1.3 percent, compared on a pro-forma basis and at constant currency, to 5,826 million euros (pro-forma prior year: 5,947 million euros).

The Schaeffler Group increased its revenue in the Americas and Asia/Pacific regions for the first nine months of the year by 2.2 percent and 5.3 percent compared on a pro-forma basis and at constant currency. Europe and Greater China revenue for the same period declined by 4.0 percent and 3.6 percent compared on a pro-forma basis and at constant currency.

The Schaeffler Group generated 746 million euros in EBIT before special items in the reporting period (pro-forma prior year: 737 million euros). The EBIT margin before special items of 4.2 percent was slightly above prior year, compared on a pro-forma basis (pro-forma prior year: 4.0 percent).

Klaus Rosenfeld, CEO of Schaeffler AG, said: “The results for the first nine months demonstrate once again the stability and resilience of our company. We were able to successfully respond to shifts in demand. This can be seen in the further improvement in the E-Mobility EBIT margin and the continued strong contribution to the group’s earnings made by the Vehicle Lifetime Solutions division. The Powertrain & Chassis business performed in line with expectations, while Bearings & Industrial Solutions increased its EBIT margin thanks to noticeably improved operating performance. Meanwhile, one year after the acquisition, we are well on track with integrating Vitesco and will leverage this new strength even better in the future for the benefit of our customers.”

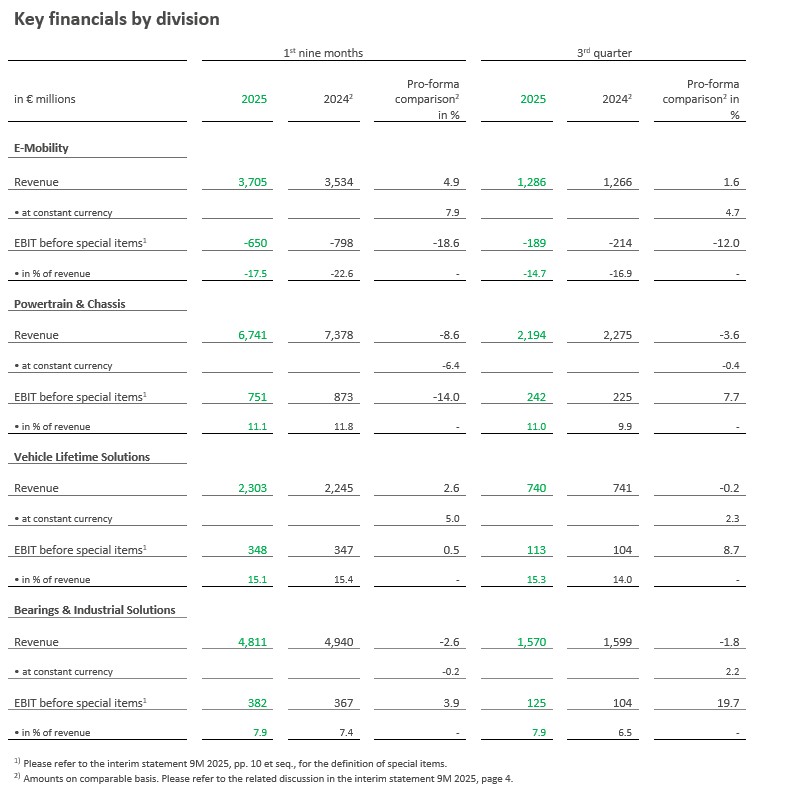

E-Mobility – Double-digit increase in Electric Drives revenue

E-Mobility division revenue for the first nine months of 2025 increased by 7.9 percent, compared on a pro-forma basis and at constant currency, to 3,705 million euros (pro-forma prior year: 3,534 million euros). This revenue growth resulted mainly from increased production of electrified vehicles. Hence, revenue of the Electric Drives and Controls business divisions (BDs) rose by a considerable 17.7 percent and 8.1 percent during the first nine months of the year compared on a pro-forma basis and at constant currency, primarily due to product-ramp ups in the Europe and Americas regions.

The division’s nine-month order intake amounted to 5.8 billion euros, including 1.2 billion euros for the third quarter.

EBIT before special items generated during the reporting period was -650 million euros (pro-forma prior year: -798 million euros). This represents an improved EBIT margin before special items of -17.5 percent (pro-forma prior year: -22.6 percent). The improvement in the EBIT margin before special items, compared on a pro-forma basis, was primarily the result of increased volumes.

Powertrain & Chassis – EBIT margin before special items 11.1 percent

Revenue for the first nine months of 2025 decreased by 6.4 percent, compared on a pro-forma basis and at constant currency, to 6,741 million euros (pro-forma prior year: 7,378 million euros). The main driver was a decline in demand from the established Western manufacturers in the Europe region that was not fully offset by third-quarter growth in the Greater China region. The strategic streamlining of the portfolio had an additional impact. The division’s nine-month order intake amounted to 6.3 billion euros, including 1.6 billion euros for the third quarter.

The Powertrain & Chassis division generated 751 million euros in EBIT before special items during the reporting period (pro-forma prior year: 873 million euros). The resulting EBIT margin before special items for the first nine months of 2025 amounted to 11.1 percent (pro-forma prior year: 11.8 percent), primarily due to the adverse impact of volumes and foreign exchange rates.

Vehicle Lifetime Solutions – EBIT margin before special items 15.1 percent

Vehicle Lifetime Solutions division revenue for the reporting period rose by 5.0 percent, compared on a pro-forma basis and at constant currency, to 2,303 million euros (pro-forma prior year: 2,245 million euros). The increase is largely attributable to the impact of volumes.

Nine-month EBIT before special items of 348 million euros was flat with prior year (pro-forma prior year: 347 million euros), representing an EBIT margin before special items of 15.1 percent (pro-forma prior year: 15.4 percent). This trend was primarily due to the favorable impact of volumes and prices, offset by the impact of the revenue mix and foreign exchange rates.

Bearings & Industrial Solutions – EBIT margin above prior year

Bearings & Industrial Solutions division revenue for the first nine months of 4.811 million euros was in line with the prior year level, compared on a pro-forma basis and at constant currency (pro-forma prior year: 4,940 million euros), with the increase in volumes in the Greater China region offsetting the market-driven decline in volumes in the Europe region.

The division generated EBIT before special items of 382 million euros during the reporting period (pro-forma prior year: 367 million euros). The improvement in the EBIT margin before special items to 7.9 percent (pro-forma prior year: 7.4 percent) was primarily driven by improved operating performance, especially at the production plants.

Free cash flow – Considerably improved compared on a pro-forma basis

Free cash flow before cash in- and outflows for M&A activities for the nine-month period amounted to 47 million euros, considerably above the pro-forma prior year amount of -960 million euros . In the third quarter of 2025, the Schaeffler Group generated free cash flow before cash in- and outflows for M&A activities of 175 million euros (pro-forma prior year: -364 million euros). This growth is attributable to increased profitability, disciplined inventory management, and a cautious capital expenditure policy driven by the market environment. Capital expenditures on property, plant and equipment and intangible assets (capex) for the reporting period were 699 million euros (pro-forma prior year: 1,072 million euros).

Christophe Hannequin, CFO of Schaeffler AG, said: “We succeeded in improving our profitability and reducing our capital expenditures in the first nine months of 2025. At the same time, we have maintained our operational strength by continuing to invest in targeted areas. This approach is reflected in a considerably improved free cash flow for the reporting period on a pro-forma basis, particularly in the third quarter. This performance will help us to deliver on our stated objective to improve our leverage ratio.”

The net loss attributable to shareholders of the parent company for the nine-month period amounted to 244 million euros. Earnings per common share were -0.26 euros. Earnings were adversely affected by an impairment loss on software licenses. Before special items, net income attributable to shareholders of the parent company for the reporting period amounted to 55 million euros.

The Schaeffler Group’s net financial debt amounted to 5,108 million euros as at September 30, 2025, and the net financial debt to EBITDA ratio before special items on a pro-forma basis as at the same date was 2.3. The ratio of net financial debt to shareholders’ equity (gearing ratio) amounted to 163.6 percent.

The company had a workforce of 112,035 employees worldwide as at September 30, 2025 (December 31, 2024: 115,055 employees).

Outlook – Guidance for free cash flow before M&A activities raised

At its meeting on October 28, 2025, the Board of Managing Directors of Schaeffler AG confirmed the guidance for revenue and the EBIT margin before special items issued on February 18, 2025, and raised the guidance for free cash flow before cash in- and outflows for M&A activities to 0 to 200 million euros.

For the Bearings & Industrial Solutions division, the company now expects an EBIT margin before special items of 6 to 8 percent and continues to anticipate revenue of 6 to 6.75 billion euros.

Klaus Rosenfeld, CEO of Schaeffler AG, said: “Our raising the guidance for free cash flow before M&A activities reflects the favorable results of operations of the Schaeffler Group for the first nine months of 2025. At Bearings & Industrial Solutions, our package of profitability improvement measures is making an impact. We expect the profitability of the Bearings & Industrial Solutions division to continue to improve.”

1 The pro-forma comparative amounts are based on the assumption that Vitesco was acquired as at January 1, 2024, and is therefore included in full in the prior year amounts. See pg. 4 of the interim statement 9M 2025 for further information. The above pro-forma amounts 2024 and the related information were not subject to the 2024 financial statement audit.

2 Includes one-off Vitesco payments related to Contract Manufacturing business, primarily driven by payment terms adjustments.

You can find press photos of the Executive Board members here: www.schaeffler.com/en/executive-board

Forward-looking statements and projections

Certain statements in this press release are forward-looking statements. By their nature, forward-looking statements involve a number of risks, uncertainties and assumptions that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements. These risks, uncertainties and assumptions could adversely affect the outcome and financial consequences of the plans and events described herein. No one undertakes any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. You should not place any undue reliance on forward-looking statements which speak only as of the date of this press release. Statements contained in this press release regarding past trends or events should not be taken as representation that such trends or events will continue in the future. The cautionary statements set out above should be considered in connection with any subsequent written or oral forward-looking statements that Schaeffler, or persons acting on its behalf, may issue.

Publisher: Schaeffler (Singapore) Pte. Ltd.

Country: Singapore

Press releases

Package (Press release + media)